STORIES OF TRANSFORMATION

VIDEO TESTIMONIES

WHY WE GIVE TO LTI

Every Gift Matters

After 20 years of coming alongside others in their spiritual formation, discernment, and renewal, we’re convinced more than ever that the ministry of LTI is vital to the Body of Christ.

Your tax-deductible donation supports our worldwide efforts to offer soul care retreats, workshops, resources, training through our certificate programs, podcasts, consulting, and spiritual direction.

Biblical Stewardship and Integrity

Thanks to the incredible generosity of our donor partners, prayer, discernment and the conservative funding approach of our leadership team, each year we have not been burdened by “red ink.”

As donors to Leadership Transformations Inc., we believe it is important for you to know the following financial integrity priorities which have both guided and sustained LTI since its inception in 2003.

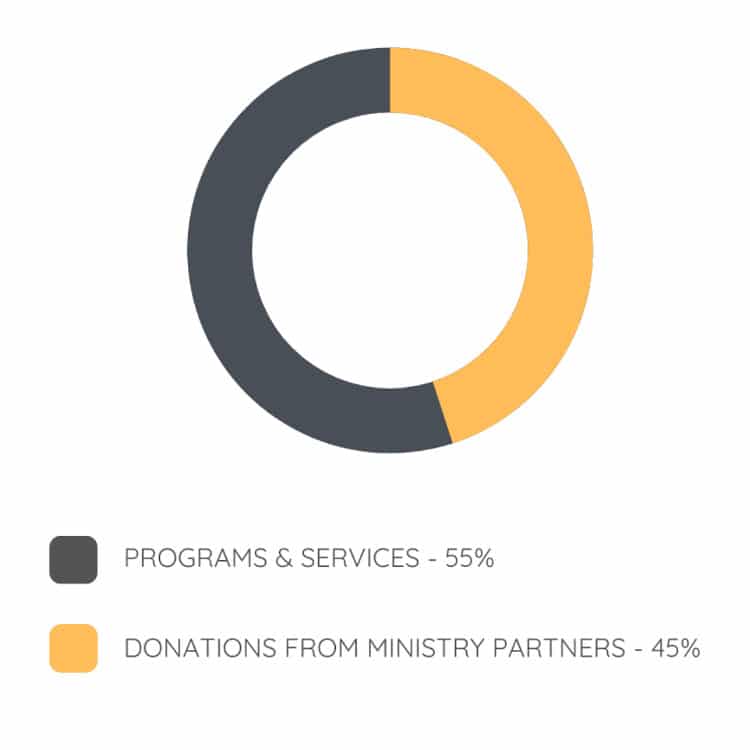

Revenue Sources

Annually, our goal is to have 50+% of our income generated from our programs and services, with the remainder provided by our donor partners.